Life Insurance in a Digital Age: What’s New in 2023

Table of Contents

- Introduction

- Digital Transformation in Life Insurance

- Emerging Technologies in 2023

- Data-Driven Insights and Personalization

- A Customer-Centric Approach

- Regulatory Challenges and Opportunities

- Practical Tips for Consumers

- Conclusion

Introduction

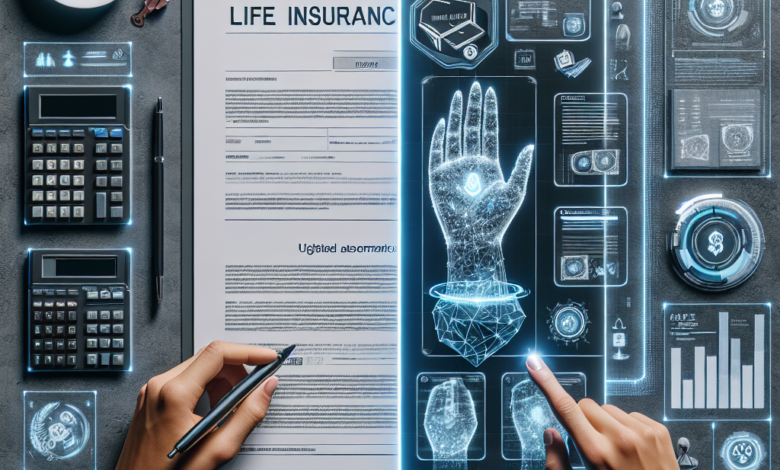

As we navigate through 2023, the life insurance industry is undergoing significant changes, driven by the digital revolution. The integration of technology into life insurance processes has not only enhanced efficiency but also transformed customer experiences. This article delves into the latest advancements in the life insurance sector, highlighting the impact of digital innovations, emerging technologies, and evolving consumer expectations.

Digital Transformation in Life Insurance

The digital age has ushered in a new era for life insurance providers. Automation, artificial intelligence, and blockchain technology are streamlining processes and reducing operational costs. Digital platforms facilitate seamless interactions between insurers and policyholders, making the entire process more transparent and user-friendly.

Emerging Technologies in 2023

Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing risk assessment and underwriting processes. By analyzing vast amounts of data, these technologies enable insurers to offer personalized policies and competitive premiums. AI-driven chatbots and virtual assistants provide 24/7 customer support, enhancing user experience.

Blockchain Technology

Blockchain is enhancing the security and transparency of life insurance transactions. Smart contracts automate claims processing, reducing the time and resources required to settle claims. This technology also minimizes fraud risks by ensuring data integrity and traceability.

Internet of Things (IoT)

IoT devices, such as wearable fitness trackers, are providing insurers with real-time data on policyholders’ health and lifestyle. This data allows for dynamic policy adjustments and encourages healthier habits, ultimately benefiting both insurers and customers.

Data-Driven Insights and Personalization

In 2023, data analytics plays a crucial role in shaping life insurance products. Insurers are leveraging big data to gain insights into customer behavior and preferences. This enables them to tailor policies to individual needs, offering greater value and satisfaction to policyholders.

A Customer-Centric Approach

Today’s consumers expect personalized and convenient services. Life insurers are embracing a customer-centric approach by offering digital platforms for policy management and claims processing. Online tools and mobile apps empower customers to access information and make informed decisions about their policies.

Regulatory Challenges and Opportunities

While digital advancements offer numerous benefits, they also pose regulatory challenges. Insurers must navigate complex regulations related to data privacy and cybersecurity. However, compliance with these regulations also presents opportunities to build trust with customers and differentiate themselves in the market.

Practical Tips for Consumers

- Research and Compare: Utilize online platforms to compare different life insurance policies and providers. Consider factors such as coverage, premiums, and customer reviews.

- Leverage Technology: Use digital tools and mobile apps to manage your policy efficiently. Stay informed about policy updates and claims processes.

- Prioritize Data Security: Be mindful of data privacy and choose insurers with robust cybersecurity measures to protect your personal information.

- Stay Informed: Keep up with industry trends and advancements to make informed decisions that align with your financial goals.

Conclusion

As we look to the future, it’s clear that the life insurance industry is evolving rapidly in response to digital innovations. The integration of emerging technologies is transforming how insurers operate and engage with customers. By embracing these changes, the industry is poised to offer more personalized, efficient, and customer-centric services. For consumers, staying informed about these advancements will empower them to make better decisions and secure their financial future.